Recognizing Insurance Policy Alternatives For Substance Abuse Therapy: An Overview

Recognizing Insurance Policy Alternatives For Substance Abuse Therapy: An Overview

Blog Article

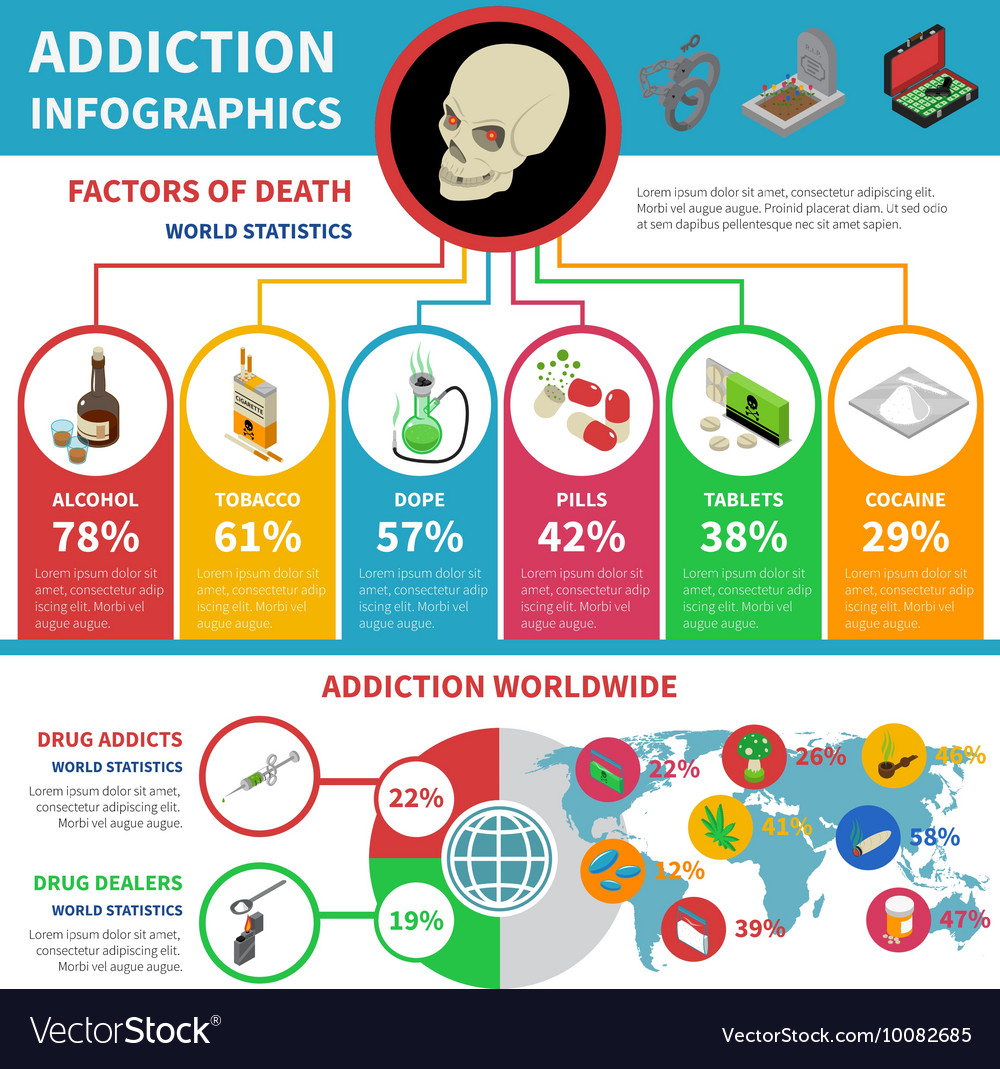

What Causes Drug Addiction CA -Orr Choate

Envision browsing insurance protection for Drug rehabilitation as trying to assemble a complicated problem. Each item stands for a various element of your policy, and the challenge depends on straightening them completely to guarantee thorough protection.

Recognizing the intricacies of insurance policy can be challenging, however are afraid not, as we break down the essential components that will certainly equip you to make educated decisions and safeguard the assistance you need.

Recognizing How To Stop Substance Abuse And Drug Addiction California is the very first step in your trip to optimizing the advantages offered to you.

Understanding Insurance Coverage Protection Essential

To comprehend the basics of insurance policy protection for Drug rehab, start by comprehending just how your policy features. Check into whether your insurance policy strategy includes mental wellness and chemical abuse advantages. Inspect if there are any type of particular needs for insurance coverage, such as pre-authorization or referrals.

Comprehending your insurance deductible and copayment obligations is critical. Acquaint on your own with the regards to your policy, like in-network companies versus out-of-network providers. Understanding the degree of coverage your insurance policy provides for different types of therapy programs will certainly aid you prepare properly.

Track any constraints on the number of sessions or days covered to prevent unexpected prices. Being aggressive in comprehending your insurance coverage can make a substantial difference in accessing the care you need.

Trick Variables for Protection Determination

Understanding vital variables that establish coverage for Drug rehab under your insurance coverage is necessary for navigating the procedure efficiently.

https://anotepad.com/notes/rqn49jdq that affect coverage include the type of treatment facility, the specific services provided, the period of treatment, and whether the facility is in-network or out-of-network.

In-network centers are usually more affordable since they have actually bargained rates with your insurance provider.

In Resurgence California Alcohol & Drug Rehab Near Me Transformative Drug Rehab in California - Reclaim Your Life , your insurance coverage plan may call for pre-authorization for treatment or have particular criteria that must be met for protection to be approved.

It's crucial to review your plan very carefully, comprehend these essential elements, and interact effectively with your insurance supplier to guarantee you maximize your protection for Drug rehabilitation.

Tips for Maximizing Insurance Perks

To take advantage of your insurance policy advantages for Drug rehabilitation, it is necessary to be positive in checking out methods to maximize coverage. Right here are some suggestions to assist you maximize your insurance coverage advantages:

- ** Evaluation Your Plan **: Understand what your insurance covers and any restrictions that may apply.

- ** In-Network Providers **: Choose rehabilitation facilities and healthcare professionals that are in-network to minimize out-of-pocket prices.

- ** Use Preauthorization **: Get preauthorization for treatment to make sure insurance coverage and prevent unforeseen costs.

- ** Charm Denials **: If an insurance claim is denied, don't think twice to appeal the decision with added info or support from your doctor.

Conclusion

Equally as a compass overviews a ship through treacherous waters, comprehending insurance policy protection for Drug rehabilitation can navigate you in the direction of the ideal treatment path.

By knowing the basics, vital factors, and ideas for making best use of advantages, you can steer clear of barriers and reach the safety of recovery with self-confidence.

Allow your insurance policy coverage be the guiding light that leads you in the direction of a brighter, much healthier future.